Montana RV Registration: The No-Nonsense Guide to Massive Savings

Thinking of registering an RV in Montana? Whether you own a Class A motorhome, fifth-wheel, travel trailer, or towable toy hauler, Montana’s registration system is unique in ways that can mean big savings, but it also comes with rules, paperwork, and legal points you should know. This guide walks you through everything: what Montana RV registration means, who qualifies, the documents and fees, the common route of using a Montana LLC, renewal and temporary permits, plus pros, cons, and red flags so you can decide with confidence.

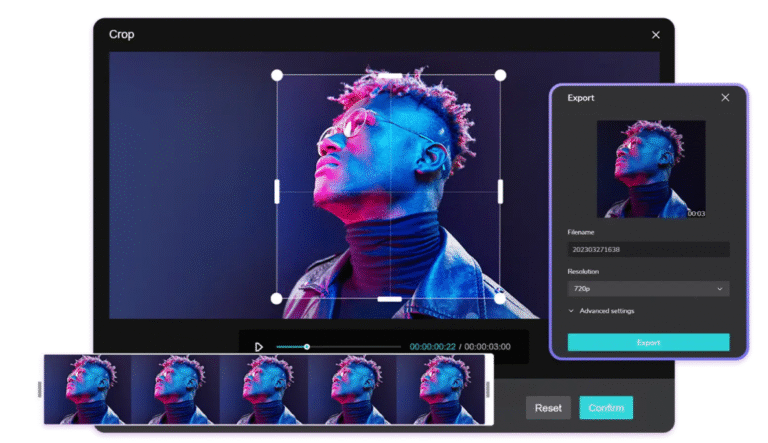

If you want a fast-start option, many RV owners use services such as 1 Dollar Montana, which can handle paperwork and Montana Vehicle Registration on your behalf.

Quick snapshot (what you need to know right away)

- Montana charges registration fees that vary by vehicle type, age, and weight — motorhomes and travel trailers are handled under separate fee tables.

- Montana does not charge a statewide vehicle sales tax the way many states do; many owners form a Montana LLC to register high-value rigs to avoid large sales taxes in their home states (this is common but has legal and residency considerations).

- To register, you’ll typically complete Montana title/registration forms, present ownership documents (title or bill of sale), and pay the registration fee and any county option tax where applicable. Forms and exact requirements are handled by the Montana MVD and county treasurer’s offices.

- Temporary registration permits and short-term fees apply in certain cases (e.g., $19.50 for some temporary permits under state statute).

What is Montana RV registration, exactly?

Montana RV registration is the state’s process for titling and registering recreational vehicles (motor homes, travel trailers, fifth-wheels, etc.) so they can legally operate on public roads. Registration shows legal ownership and provides license plates/registration stickers. Montana’s MVD (Motor Vehicle Division) publishes fee tables and forms for different vehicle classes — for example, “Motor Home Registration and Fees” for self-propelled RVs, and “Travel Trailer Registration and Fees” for towables; fees depend on age, length/weight, and other factors.

Because Montana does not impose a general statewide sales tax on vehicle purchases the same way other states do, registering a high-value RV in Montana is attractive to many buyers, especially those who plan long-term travel or who own luxury rigs. That said, the practice can involve using an LLC or a representative service; it’s not automatic or without legal nuance.

Why people choose Montana for RV registration (the main advantages)

- Potential sales-tax savings: Montana lacks a general vehicle sales tax that many other states charge at purchase; registering through a Montana entity may reduce or eliminate the large one-time sales tax paid in some states. Commercial services and guides commonly explain this saving as a primary motivator.

- Flat or lower registration fees for high-value vehicles: Montana’s fee structure (including “luxury” or flat fees for certain vehicles) can be far cheaper annually than paying a percentage of purchase price in sales tax.

- No emissions testing or state vehicle inspections (in many counties): For many RV owners from states with emissions programs, Montana’s looser inspection environment is attractive. (Always check county rules and your home-state obligations.)

- Remote management via registered agent/LLC services: Many out-of-state owners use Montana-based registered agent services to form an LLC and handle registration paperwork, mailing plates, and documents back to the owner. These services (commercial examples: 1 Dollar Montana, 49DollarMontana, MyMontanaLLC, DirtLegal, etc.) are widely advertised.

Important legal note: While these advantages exist, using a Montana LLC to register an RV when you live elsewhere raises residency, tax, and title issues in your home state. Some states view such registrations as tax avoidance and may require you to register locally if the vehicle is principally garaged there. Always confirm with your home state’s DMV and a tax/legal advisor before proceeding.

Basic eligibility & who can register an RV in Montana

- Residents of Montana can register vehicles directly with county treasurer offices or online, where applicable. Non-residents may register an RV in Montana under certain conditions (commonly by forming a Montana LLC that is the owner, or by working with an in-state agent), but the situation depends on intent, use, and state rules. Commercial registration service pages and legal summaries explain the LLC route in practical terms.

- If your RV is financed and there’s a lienholder, expect additional steps: the lienholder often must release the title or consent to transfer/title in the name of an LLC. MVD forms and county offices handle lien documentation.

Step-by-step: How to register an RV in Montana (standard route)

Below is a practical, generic set of steps most owners follow. Specific county treasurer offices may have local variations — always confirm with the Montana MVD or your county treasurer.

Gather documents

- Original vehicle title in seller’s name (or lienholder documentation).

- Bill of sale (if a title isn’t yet available).

- Proof of identity and any required signatures.

- If using an LLC: LLC formation documents, Montana registered agent address, and any documents showing your authority to act for the LLC.

- Completed Montana registration/title application (Form MV1 and any county addenda).

Complete the application

- Fill out the Montana Vehicle Registration / Title application (MV1 or county version). If you’re using a registration service, they typically complete the application for you and submit it in-state.

Pay fees

- Pay the applicable registration fee, any Montana Highway Patrol fee, and any local option tax your county charges. Fee amounts vary by vehicle classification (motorhome vs travel trailer), age, weight/length, and county. Examples: travel trailer base fees and motorhome fee tables are published by MVD.

Submit in person or by mail (or have an agent submit)

- Submit at a county treasurer’s office, mail the documents where allowed, or have your Montana LLC service/registered agent present paperwork in person and return the plates/registration to you via mail. Some forms cannot be submitted online and must be printed and mailed or brought to the county.

Receive plates and registration

- Once processed, you’ll receive Montana plates and registration. If an LLC/agent registered the RV, they’ll typically forward the physical plates and registration to you.

Fees: examples & what to expect

Montana publishes fee tables for different vehicle types. Two useful examples:

- Travel trailers: Montana’s “Travel Trailer Registration and Fees” page lists flat fees based on trailer length (e.g., under 16 feet, 16 feet and over) plus any applicable additional fees.

- Motor homes: Montana’s “Motor Home Registration and Fees” page shows fee tiers based on age and other criteria (older motorhomes typically have lower annual fees).

In addition, there can be a Montana Highway Patrol salary/retention fee and county option taxes. Counties may impose an additional local option motor vehicle tax up to certain limits (historically up to 0.7% of retail value or a flat fee, depending on statutes and county choices). For authoritative fee totals, consult the MVD fee pages and your county treasurer.

Temporary permits & short-term travel

If you need to move a vehicle before full registration is complete, Montana provides temporary registration permits in certain circumstances; state statute notes a typical temporary permit fee (for some permits) of $19.50. County rules and dealership practices vary, so verify what specific temporary paperwork applies to your transaction.

The Montana LLC route — how it works (and why people use it)

A widely used method to register an RV in Montana when the owner lives elsewhere is to form a Montana limited liability company (LLC). The LLC becomes the legal owner of the vehicle; because the LLC is registered in Montana, the vehicle is registered in Montana. Many registered agent companies handle the entire process: form the LLC, provide a local registered agent/address, submit registration paperwork at the county treasurer’s office, and mail plates/registration to the owner. Commercial services (e.g., 1 Dollar Montana, 49DollarMontana, MyMontanaLLC) advertise full-service packages to simplify the process.

Typical steps for the LLC method

- Form a Montana LLC (articles of organization filed with the Secretary of State).

- Obtain an EIN if required and open an LLC bank account if needed by your service.

- Purchase the RV in the LLC’s name or transfer title to the LLC.

- Register/title the RV at a Montana county treasurer using the LLC as the owner.

- Receive Montana plates and registration; the LLC remains the titled owner while you operate the RV.

Why do owners do it

- Avoid large one-time sales tax in other states for expensive RV purchases.

- Lock in a potentially lower annual fee structure for high-value vehicles.

Risks and legal considerations

- Your home state may require registration there if the vehicle is principally garaged or used there. States differ in enforcement — some aggressively pursue such arrangements, others rarely do.

- If financed, lenders must accept the title in an LLC’s name; some lenders resist or require special arrangements.

- Some states consider this tax avoidance; penalties, back taxes, or required registration in your home state are possible if the state concludes the vehicle’s primary residence/garaging is there. Consult a tax attorney or your home-state DMV before using this route.

Using a registration service (what they do and common pricing)

Registration services advertise that they’ll form the LLC, provide a Montana address and registered agent, complete local registration, and mail plates and documents back to you. Pricing varies widely: some low-cost services advertise prices like “$1” for marketing purposes, but typically that covers only a small part of the process — full packages often range from a few hundred to a thousand dollars, depending on included services (LLC formation, annual registered agent fee, registration filing, shipping, etc.). If you choose a service, read the terms carefully about what’s included and the ongoing fees.

Renewal, ongoing compliance, and annual requirements

- Montana registration renewals and fee renewals are handled at the county level; the renewal cadence and fee depend on vehicle type and county practice. Motorhomes and trailers have specific renewal fee tables. Check the MVD site and your county treasurer for renewal windows.

- If you use an LLC, remember the LLC has its own ongoing compliance obligations (annual registered agent fees, possible state filings) that you must maintain to keep the registration valid.

Common questions & quick answers

Q: Will registering an RV in Montana permanently exempt me from sales tax in my home state?

Not necessarily. Many states assess use tax or have rules requiring local registration if the vehicle is principally used or garaged there. Registering in Montana alone doesn’t guarantee immunity from home-state tax obligations. Consult your home state DMV or a tax professional.

Q: Can I drive my Montana-registered RV anywhere in the U.S.?

In most cases, yes — Montana plates are valid across the U.S., but border crossings, home-state laws, and some localities may have additional requirements. If you’re stopped, carry registration, proof of ownership, and any LLC paperwork if applicable.

Q: Is the $1 advertised by some services the real price?

Marketing offers like “$1 Montana” are typically promotional and do not reflect the full cost of LLC formation, agent fees, registration fees, or county taxes. Read the full pricing breakdown before committing.

Practical checklist: documents to have ready

- Title (original) or lien-release documentation.

- Bill of sale (with purchase price and seller information).

- Completed Montana MV1 or applicable county registration form.

- Proof of LLC formation and registered agent details (if using LLC).

- Lienholder contact/consent if financed.

- Payment method for MVD/county fees and service fees.

Red flags & best practices

- Don’t assume it’s risk-free. Check your home state’s rules about out-of-state registration to avoid unexpected tax bills or penalties.

- Vet service providers. Read multiple reviews and ask detailed questions: Who files the paperwork? Where are plates mailed? What’s covered by any guarantee? Confirm refund and cancellation policies.

- Keep complete records. If you form an LLC, maintain LLC paperwork, register agent receipts, and all registration documents in case you need to show legal ownership or residency intentions.

Real-world example scenarios

Scenario A — Full-time RVer buying a $150,000 Class A motorhome: Registering through Montana (via an LLC) can produce substantial one-time savings compared to a 6–8% sales tax in some states, plus possibly lower annual fees. But evaluate lender requirements and home-state tax exposure first.

Scenario B — Weekend traveler with a $25,000 travel trailer: The relative savings may be smaller once service fees and LLC maintenance are included; direct registration in your home state might be simpler. Check county travel trailer fees in Montana for comparison.

Where to get official, authoritative help

- Montana Motor Vehicle Division (MVD) — official pages for vehicle registration, motorhome and travel trailer fees, forms, and FAQs. Always your primary authoritative source for rules and fees.

- County Treasurer’s Office — the office that processes registrations; local rules and local option taxes are administered at the county level.

- Reputable legal/tax advisor — if you plan to form an LLC for registration, consult a tax attorney or CPA familiar with motor vehicle taxes and multi-state issues.

Final checklist before you commit to Montana RV Registration

- Compare total costs: Montana registration fees + LLC formation + registered agent fees + shipping vs. home-state sales/use tax.

- Confirm lender acceptance if financed.

- Check your home state rules on garaging/principal use.

- Verify what a chosen Montana service actually provides and whether they’re transparent about total costs and ongoing obligations.

Conclusion: Montana RV Registration

Montana RV Registration can offer significant benefits, especially for high-value motorhomes, but it’s not a one-size-fits-all solution. You’ll want to weigh the registration fees published by the Montana MVD, county taxes, and the legal/tax implications in your home state.

If you’d prefer a hands-off approach, companies such as 1Dollar Montana offer full-service handling of LLC formation and in-state registration (confirm the total price and services included before committing).